Primax closely monitors global climate change trends and international response strategies, recognizing climate change as one of the most significant issues and critical risks in the Company's sustainable development. The Company continuously analyzes and manages related impacts and is committed to greenhouse gas adaptation and mitigation efforts. In 2021, Primax Group officially signed on as a TCFD Supporter and published its first TCFD Report in 2022. In 2024, Primax further aligned with IFRS S2 Climate-related Disclosures issued by the International Sustainability Standards Board (ISSB). The preparation of this year's TCFD report also referenced the IFRS S2 disclosure examples jointly developed by Taiwan's Financial Supervisory Commission and the Accounting Research and Development Foundation. For the complete disclosure, please refer to Primax Group's fourth 《TCFD Report》, or see this report's sections 《2.1 Sustainability Management and Practice》 and 《3.6 Risk Management.》 A summary of selected content is provided below:

Climate-related governance

In November 2021, Primax established the Risk Management Committee under the Board of Directors to advance the Company's sustainable development objectives, strengthen risk management mechanisms, and enhance corporate governance practices. In 2024, upon approval by the Board of Directors, the committee was renamed the Sustainability and Risk Management Committee, serving as the dedicated body responsible for overall risk management at Primax. The Sustainability and Risk Management Committee is chaired by the Chairman and regularly reports to the Board of Directors to ensure that Board members are informed of the potential impacts of enterprise risk issues on Company operations and the current response strategies.

The identification results, strategies, and target setting related to climate risks and opportunities presented in this report were reported on May 8, 2025, by the Vice President of Sustainability, serving as the convener of the ESG Office, to the Sustainability and Risk Management Committee. On the same day, the Committee Chair, Chairman Pan, Yung-Chung, reported to the Board of Directors, and the disclosures were approved. In 2024, the Sustainability and Risk Management Committee convened three meetings.

In addition, Primax has established multiple mechanisms and initiatives, including strengthening the climate-related knowledge of the Board of Directors and management, implementing an incentive program for employee energy-saving proposals, and linking 10–15% of variable compensation for senior executives to sustainability performance. In 2024, the Company further introduced sustainability performance incentives for regional manufacturing leaders, the most senior R&D executives, and the chief procurement officer. Primax also held its first Makerthon proposal competition to accelerate green operations and achieve greenhouse gas reduction targets.

Climate Risk and Opportunity Assessment andManagement

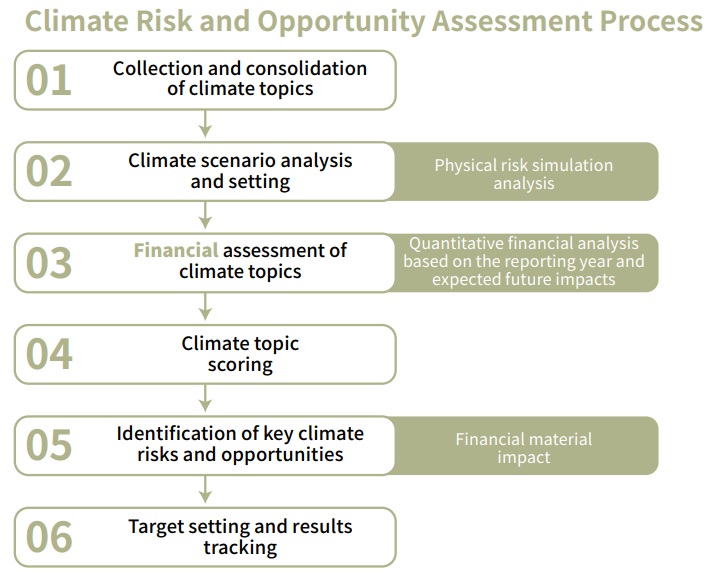

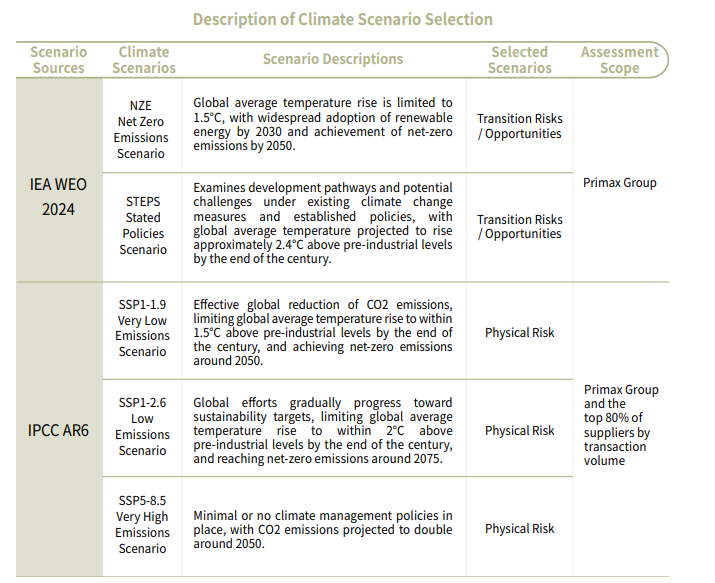

Primax conducts research and evaluation on domestic and internationalclimate change-related laws and regulations and initiatives as a consideration for the Group to formulate environmental policies, to comply with domesticdevelopment trends, and to enhance the Company's ability to cope with climate change. The climate risk and opportunity identification process is as follows:

Climate Change Risk and Opportunity Identification Result

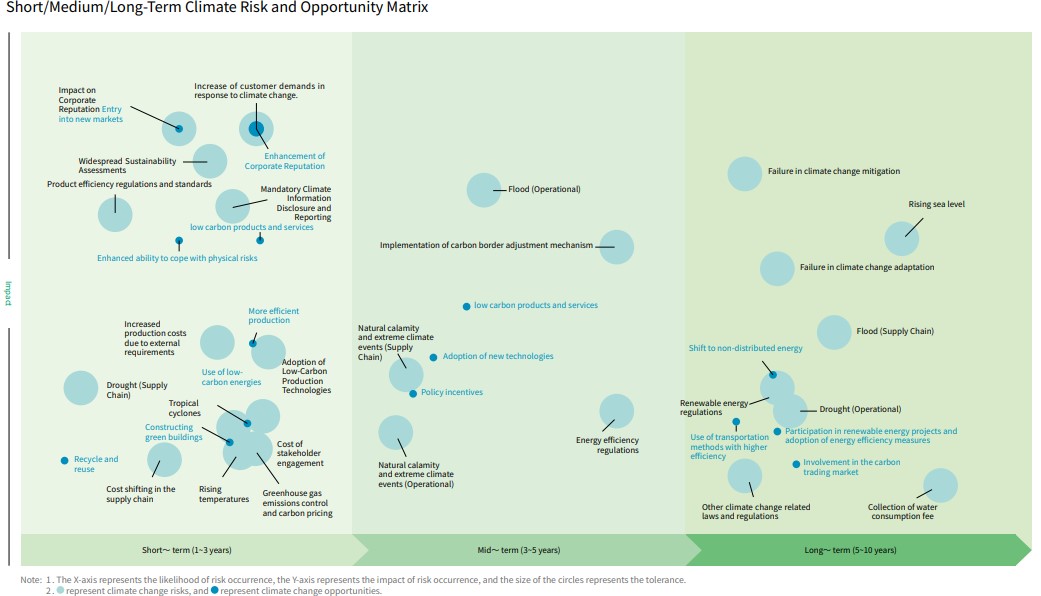

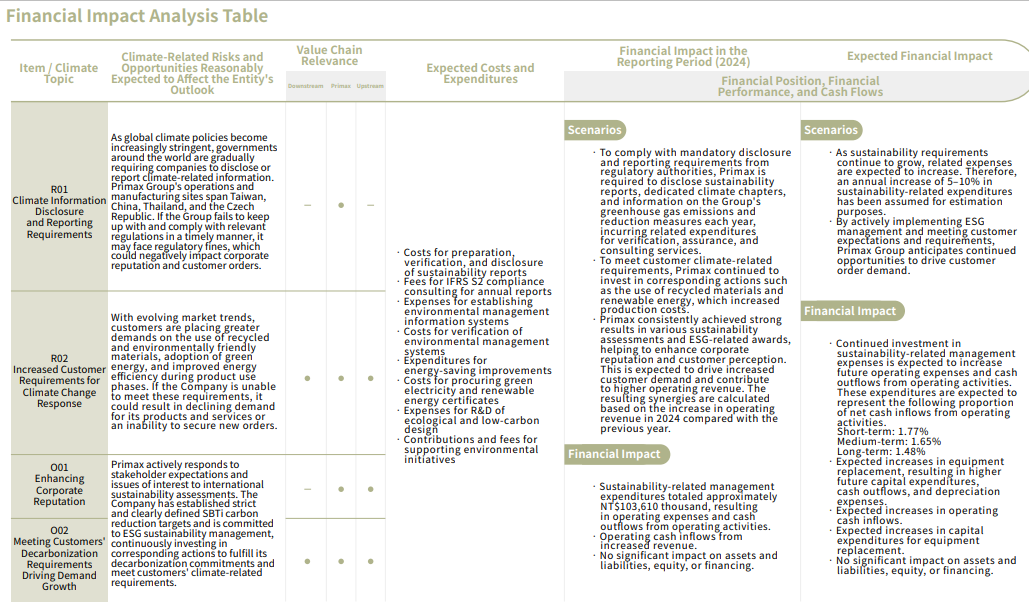

The assessment timeline for the current year was set as short-term (2025–2026), medium-term (2027–2029), and long-term (2030–2034). Each climate topic was evaluated individually to determine the risk and opportunity levels over the short, medium, and long term. Climate topics were prioritized using a risk rating determined by the scoring of "likelihood × impact." In the 2024 assessment, no items were identified as high-risk; however, two topics were identified as having potentially high opportunities in the medium to long term. To better align with the principles of financial reporting standards, we also referenced the definition of financial materiality in the IFRS standards and applied a dual assessment approach, using an impact score of 4 as the threshold for financial materiality. According to the assessment results, in 2024, no climate risk items were identified with estimated financial impacts exceeding the financial materiality threshold. However, three climate topics were expected to potentially generate positive financial benefits through the implementation of response measures.

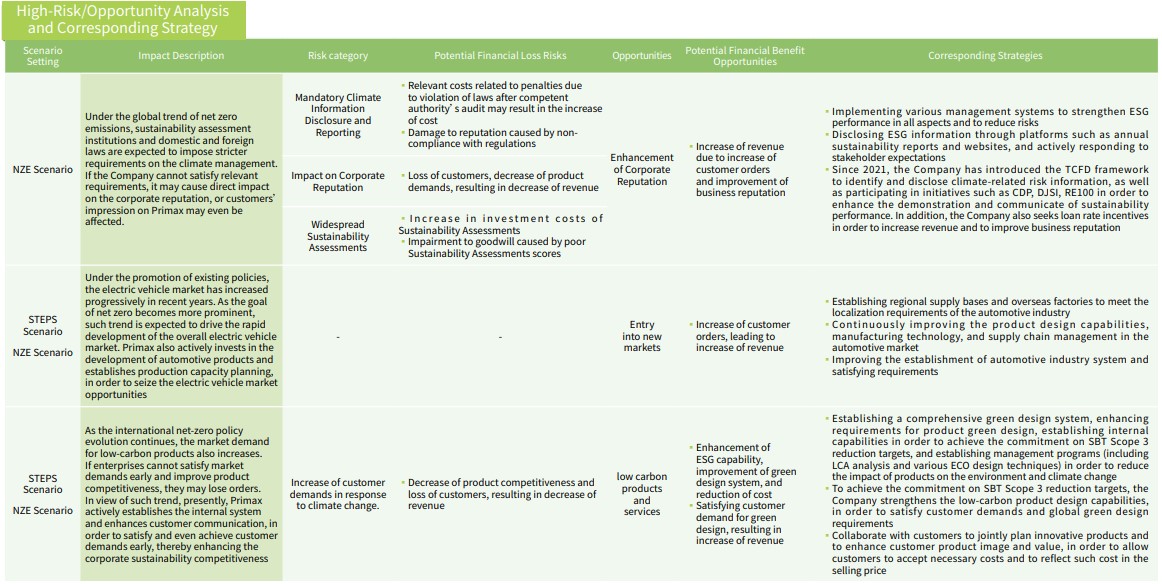

Based on the above analysis, and after discussion by the assessment team, taking into account the Company's actual circumstances and the potential challenges it may face in the future, the key climate risks and opportunities for the year were determined as presented in the table below. The ESG Office has conducted further discussions and revisions regarding response strategies and resource allocations in accordance with the assessment results. The ESG Office will continue to monitor changes in the results of the annual assessments and will regularly present both the assessment results and the decisions formulated.

Short-, Mid- and Long-Term Climate-Related Risk and Opportunity Identification Results and Strategies

To address the identified major risks and opportunities, Primax formulates risk mitigation plans for continuous monitoring and improvements according to the risk response steps set forth by its " Corporate Risk Management Policies and Procedures" regarding high-risk items or items required for reporting. The audit unit then incorporates important action plans into periodic inspections under audit plans.

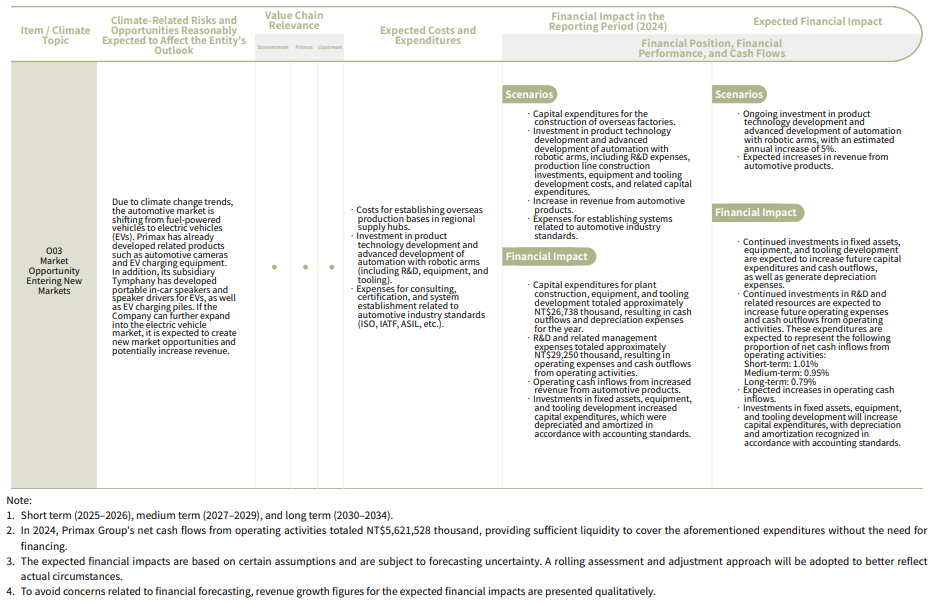

Climate-related Financial Impact Assessment

Based on the identified risks /opportunities , Primax etimates the potential financial changes that climate change may bring to Primax. It formulates risk response strategies and conducts cost and benefit assessmentsfor "Cost Management" and "Benefit Management." The financial impact of climate risks/opportunities is assessed and estimated for the short-term( 2024 ~ 2025 ), mid-term ( 2026 ~ 2028 ),and long-term ( 2029 ~ 2033 ) timeframes.

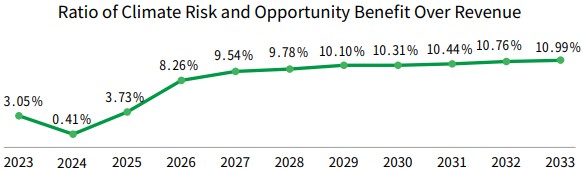

For the identified risk/opportunity items, their corresponding strategies,actions, and expected output benefits are quantified as financial information.The analysis of their impact on revenue composition is presented in the following chart. For the short term ( 2024 ~ 2025 ), the average financial impact is estimated to be approximately 2.07% of the operating revenue. For the medium term( 2026 ~ 2028 ), the average financial impact is estimated to be approximately 9.19 % of the revenue. For the long term ( 2029 ~ 2033 ), the average financialimpact is estimated to be approximately 10.52% of the revenue.

The expected investment cost for all corresponding strategies is summarized according to the risk and opportunity items identified, and such cost includes the addition of facility equipment, increase of R&D cost, cost for recycled materials, and investment in sustainability projects, etc. The financial impact scenario of Primax with respect to the climate change investment cost up to the year of 2033 is estimated.For the short term ( 2024 ~ 2025 ), the average financial impact is estimated to be approximately 1.45 % of the revenue. For the medium term ( 2026 ~ 2028 ), the average financial impact is estimated to be approximately 1.27% of the operating revenue.For the long term ( 2029 ~ 2033 ), the average financial impact is estimated to be approximately 1.24% of the operating revenue.

Net Zero Commitment

Primax actively aligns with international initiatives and internationally recognized methodologies. In 2023, the Company adopted the approach defined by the Science Based Targets initiative (SBTi) to establish emissions reduction targets for its major production sites, Primax (Kunshan) and Primax (Chongqing), in line with the 1.5° C pathway. In the ame year, these targets were officially approved by the SBTi. Based on the 2024 greenhouse gas inventory results, both sites achieved and exceeded their annual emissions eduction targets. Primax Group submitted its SBT 1.5° C net-zero commitment in January 2024 and submitted its target at the end of 2024. In April 2025, the SBTi approved he Group's 1.5° C net-zero target. Primax will continue to advance mitigation and innovation activities to reduce greenhouse gas emissions and work toward achieving net-zero emissions by 2025.

| Qualified SBTi 1.5℃ short-term goal review Qualified SBTi 1.5℃ short-term goal review in 2023 | |

| Primax Chongqing | Primax Kunshan |

|

1. Reduction of Scope 1 & 2 absolute emissions by 46% in 2030 in comparison to the emissions in the base year of 2020. 2. Reduction of Scope 3 absolute emissions for products and services purchased by 25% in 2030 in comparison to the emissions in the base year of 2021. |

1. Reduction of Scope 1 & 2 absolute emissions by 64% in the target year, 2030, in comparison to the emissions in the base year of 2020. 2. Reduction of Scope 3 absolute emissions for products and services purchased and the use of sales products by 25% in the target year, 2030, in comparison to the emissions in the base year of 2021. |

| 2023 SBT execution results | |

|

1. Scope 1+Scope 2 emits a total of 1619.2126 ton CO2e, which is a decrease of 62.91% compared with the base year of 4365.3312 ton CO2e. (Market Based) 2. Scope 3 (C1) emits a total of 143564.50 ton CO2e, a decrease of 11.10% compared with the base year of 161488.05 ton CO2e. |

1. Scope 1+Scope 2 emits a total of 738.7645 ton CO2e, which is a decrease of 68.09% compared with the base year of 2315.3017 ton CO2e. (Market Based) 2. Scope 3 (C1+C11) emits a total of 6401.94 ton CO2e, a decrease of 72.81% compared with the base year of 23541.29 ton CO2e.

|

PS: The above data does not include production from transferred factories

Please refer to "2024 TCFD Climate-related Financial Disclosures Report" for complete information on Primax's climate change risks.Please refer to the Chapter 4 Environmental Sustainability herein for climate change response management actions and performs.