Primax is a profitable company with fundamental strength

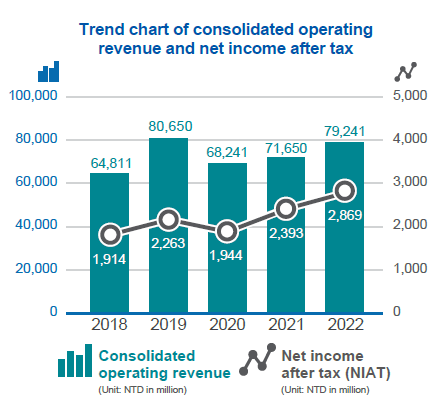

Consolidated revenues and net profit after tax

Primax is able to balance growth and risk control through a stable portfolio of product technologies and a customer base of world-leading firms. Our steady growth in revenues and profitability is reflected in the graph.

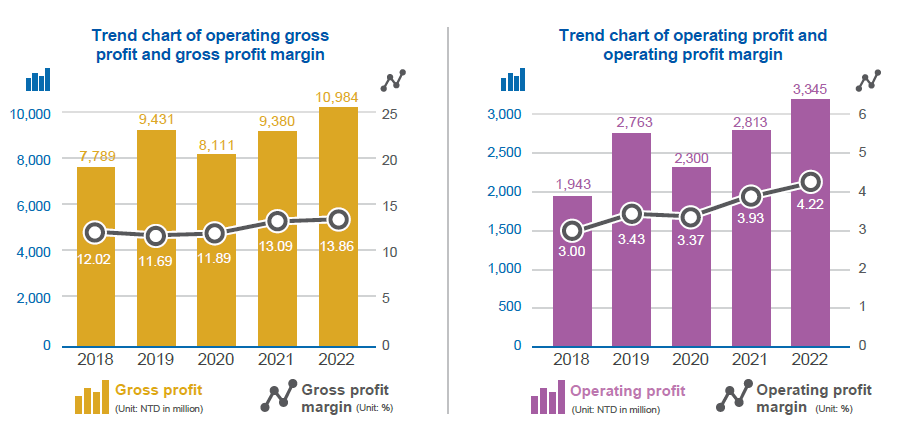

Operating Margin and Operating Profit Ratio

Primax operating margins and operating profit ratios have remained relatively stable due to our balanced product portfolio and steady customer base. Growth has been accompanied by an increase in profitability due to business expansion and optimization of product combinations.

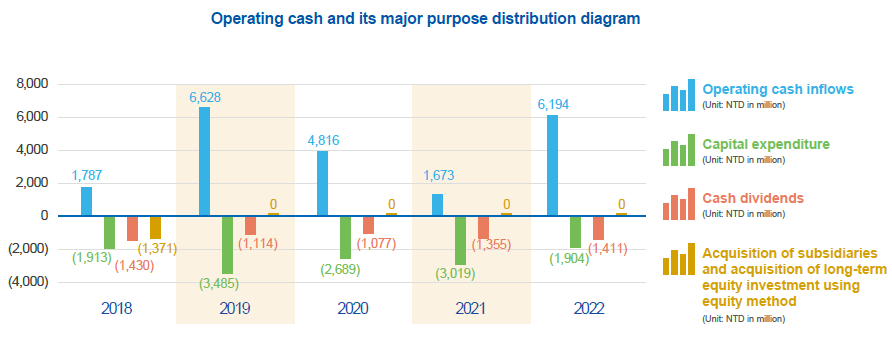

Operating Cash Inflow and its Distribution

The creation of steady operating cash inflows is a key pillar of management at Primax. A sophisticated supply chain and financial management together with embedded cash flow targets, allows constant performance evaluation of each business unit. This ensures that cash flow remains healthy while Primax pursues growth and profits.

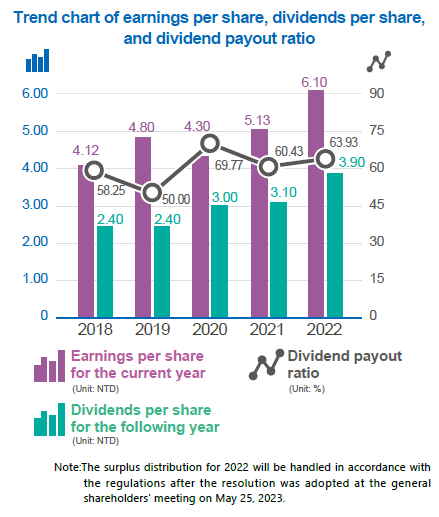

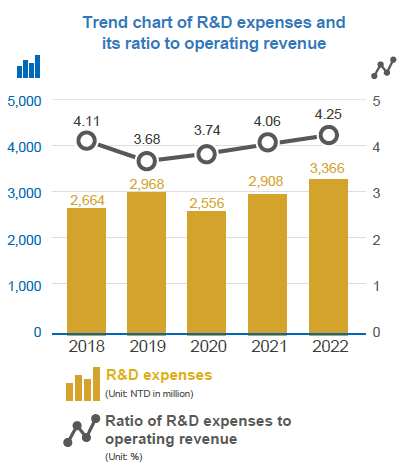

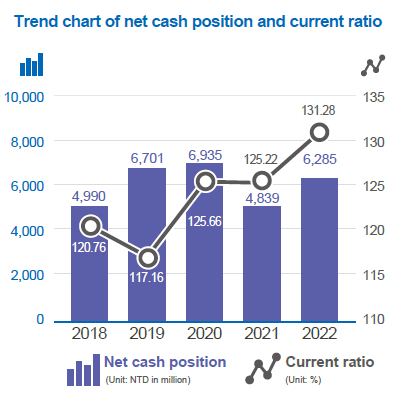

Stable dividend policy, continued R&D investment, secure capital and liquidity

Inquire → Share Price Information

- Ranked among the Top 5% listed companies for corporate governance by the Taiwan Stock Exchange

- Voluntary compilation of bilingual CSR Reports with external assessment.

- An active advocate for sustainable supply chains as well as care for workers and the environment

- Continued investment in rural education and long-term partnerships with social enterprises